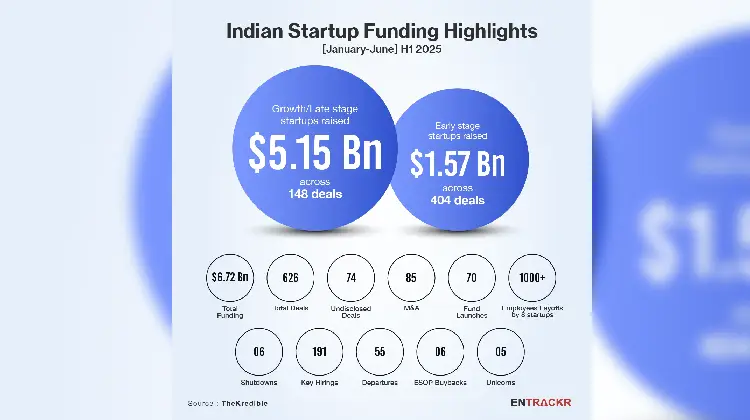

Indian startups collectively raised approximately $6.7 billion in the first half of 2025, according to data compiled by TheKredible. This indicates a consistent inflow of venture capital, mirroring the funding levels from the same period in 2024. The ecosystem also saw a continued buzz around Initial Public Offerings (IPOs) and a notable rise in mega-deals.

While some reports, like Inc42’s, indicate a slightly lower figure of $5.7 billion for H1 2025 (an 8% year-on-year growth), and Tracxn’s report suggests a 25% decline to $4.8 billion in tech startup funding compared to H1 2024, the general sentiment reflects resilience and a strategic shift in investor focus. Despite macroeconomic headwinds, several deals exceeding $100 million, including four that surpassed $200 million, underpinned the total funding.

Key Highlights of H1 2025 Funding Landscape:

- Steady Inflow and Mega Deals: The overall funding remained robust due to a significant increase in mega deals (over $100 million). Inc42 reported 11 such deals in H1 2025, a 57% surge from H1 2024. Prominent deals included Innovaccer in healthtech, Zolve in fintech, and Porter in logistics.

- New Unicorns: The first half of the year saw five new startups joining the coveted unicorn club (valuation of $1 billion or more). These included Netradyne, Drools, Porter, Fireflies AI, and Jumbotail.

- Sectoral Preferences: Fintech continued to be a favorite among investors, raising around $1.6 billion. Ecommerce also saw strong funding, with a nearly 53% jump in capital infusion. A notable emerging trend was the rise in funding for defence tech startups.

- Geographical Dominance: Bengaluru maintained its position as India’s leading startup hub, securing the highest amount of funding (around $2.5-$2.9 billion). Delhi NCR followed, attracting approximately $1.5-$1.6 billion.

- IPO Momentum: The IPO market showed signs of picking up, with companies like Pine Labs filing their IPO documents and HDB Financial making its debut. This indicates a maturing ecosystem where startups are increasingly looking towards public markets for exits. However, some reports also highlight a “crisis of confidence” in the IPO market, with many listings from 2021-2023 trading below their issue price, leading to increased scrutiny and cautiousness from investors.

- Acquisition Activity: Mergers and acquisitions saw a significant rise, with 73 startups acquired in H1 2025, compared to 54 in H1 2024. Notable acquisitions included HUL’s acquisition of Minimalist and DS Group/Patanjali Ayurved’s acquisition of Magma General Insurance.

- Shift in Investor Focus: There’s a clear trend of investors prioritizing sustainable business fundamentals, unit economics, and capital efficiency over hyper-growth models. Sectors like electric mobility, infrastructure, climate-focused logistics, AI, and hardware are attracting increased attention.

Despite some variations in reported total funding figures across different platforms, the consensus is that the Indian startup ecosystem continues to demonstrate resilience, attracting significant capital while focusing on more sustainable growth paths and exploring public market opportunities.

Key Highlights:

- Indian startups raised approximately $6.7 billion in H1 2025, driven by a surge in mega-deals, and maintaining a consistent funding pace compared to the previous year.

- Five new unicorns emerged (Netradyne, Drools, Porter, Fireflies AI, Jumbotail), while fintech and e-commerce remained top-funded sectors, and defense tech saw notable growth.

- Bengaluru and Delhi NCR continued to dominate funding, and the IPO market showed activity with new filings and listings, despite underlying concerns about post-listing performance.

- Investor focus is shifting towards sustainable business models, unit economics, and capital efficiency, with increased interest in sectors like AI, hardware, clean energy, and logistics.