Dubai’s burgeoning real estate market continues to solidify its position as a global leader in innovation, achieving a remarkable milestone of nearly $400 million in tokenized property sales in May 2025. This significant figure, accounting for 17.4% of the emirate’s total real estate transactions, underscores the growing adoption of blockchain technology in the property sector and Dubai’s ambitious push towards real-world asset (RWA) tokenization.

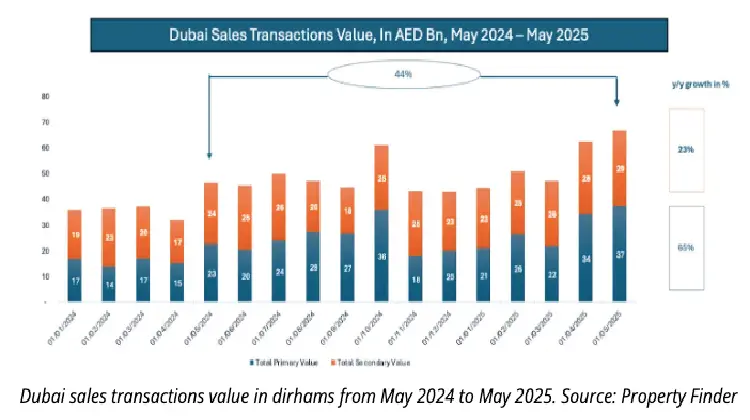

The nearly $400 million in tokenized sales comes amidst a broader real estate boom in Dubai, which saw total property sales reach an astounding AED 66.8 billion (approximately $18.2 billion) across 18,700 transactions in May. This performance reflects a 44% year-on-year increase in value, highlighting both the robust health of the market and the increasing integration of digital assets.

This surge in tokenized real estate activity is not coincidental but rather a direct result of strategic regulatory and institutional developments spearheaded by the Dubai government. Key drivers behind this rapid growth include:

- VARA’s Formal Inclusion of RWA Tokenization: On May 19, 2025, Dubai’s Virtual Asset Regulatory Authority (VARA) updated its guidelines to formally include real-world asset tokenization, providing much-needed regulatory clarity and a framework for issuers and exchanges to launch and trade compliant blockchain-based property offerings.

- Government-Backed Tokenization Platform: On May 25, 2025, the Dubai Land Department (DLD), in collaboration with the Central Bank of the UAE and the Dubai Future Foundation, launched a pioneering regional tokenized real estate platform. This initiative enables investors to purchase fractional ownership in secondary-market properties, starting with investments as low as AED 2,000 ($545). The platform currently serves UAE ID holders but plans for global expansion are underway.

- Major Industry Partnerships: A notable $3 billion deal signed on May 1, 2025, between MultiBank Group, MAG Group, and blockchain firm Mavryk, will see luxury real estate projects integrated into a regulated tokenization marketplace.

Tokenized real estate, which involves converting the value of a physical property into digital tokens on a blockchain, is revolutionizing property investment by offering:

- Increased Liquidity: Traditionally illiquid assets can be traded more easily and quickly.

- Lower Barriers to Entry: Fractional ownership allows smaller investments, democratizing access to high-value properties.

- Enhanced Transparency and Security: Blockchain provides an immutable and transparent record of ownership and transactions, reducing fraud risks.

- Global Access: Investors from anywhere in the world can participate in the Dubai property market without geographical constraints.

Industry experts believe that Dubai’s proactive regulatory stance and collaborative efforts between government bodies and private enterprises are positioning the emirate as a global hub for real estate tokenization. Scott Thiel, CEO of Tokinvest, a real-world asset tokenization platform, commented, “When you witness over AED 60 billion in property deals in a single month, it’s a clear indicator that the market is not only vibrant and liquid but ready for transformation.” He added that tokenization is quickly becoming a practical tool to increase access, efficiency, and liquidity in the property sector.

The DLD projects that tokenized assets could represent up to 7% of Dubai’s total real estate market by 2033, equating to an estimated AED 60 billion ($16 billion) in value. With continued innovation, robust regulatory support, and increasing investor confidence, Dubai is firmly establishing itself as a testbed for the future of fractionalized, blockchain-enabled real estate.

Key Highlights:

- Dubai recorded nearly $400 million in tokenized real estate sales in May 2025, representing 17.4% of total property transactions during a period of significant market growth.

- This surge is attributed to strategic regulatory developments, including VARA’s formal inclusion of real-world asset tokenization and the launch of a government-backed tokenized real estate platform by the Dubai Land Department.

- Key benefits of real estate tokenization driving this growth include increased liquidity, lower barriers to entry (fractional ownership), enhanced transparency, and global investor access.

- Dubai aims to be a global leader in real estate tokenization, with projections indicating that tokenized assets could reach $16 billion in value by 2033, transforming the property sector.