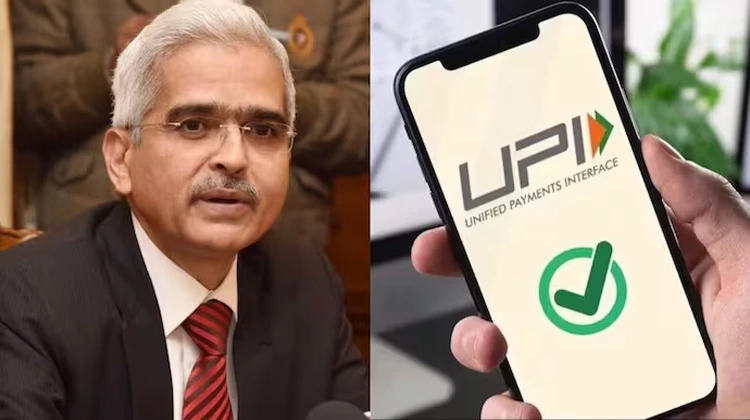

In a significant step towards promoting digital payments in India, the Reserve Bank of India (RBI) has raised the transaction limits for UPI Lite and UPI 123PAY services. The announcement, made by RBI Governor Shaktikanta Das during the recent Monetary Policy Meeting, is part of ongoing efforts to expand the reach of digital payments across the country.

These increased limits are particularly aimed at benefiting users of feature phones and those conducting low-value transactions, reinforcing India’s commitment to ensuring its digital payments landscape remains inclusive and accessible.

For UPI 123PAY, the per-transaction limit has been doubled from Rs 5,000 to Rs 10,000. UPI 123PAY allows feature phone users to make digital payments through multiple channels, including IVR calls, app-based functionality, missed call payments, and sound-based proximity payments, making it a versatile tool for users who do not have access to smartphones.

Additionally, the UPI Lite wallet limit has been increased from Rs 2,000 to Rs 5,000, and the per-transaction limit has also been raised from Rs 500 to Rs 1,000. UPI Lite is designed for small-value transactions, allowing users to make payments without real-time access to core banking systems, thereby reducing the burden on banking infrastructure.

Governor Das highlighted the pivotal role of UPI in transforming India’s financial ecosystem, emphasizing that the continuous evolution of UPI technology has made digital payments both accessible and inclusive. He reiterated the importance of enhancing user experience and enabling financial inclusion for underserved segments, such as those without smartphones or access to advanced banking apps.

These increases in transaction limits are expected to facilitate seamless low-value transactions and enhance the overall convenience of digital payments. By making digital transactions more accessible to a larger portion of the population, the initiatives are set to further strengthen UPI’s influence in India’s fast-growing digital economy.

Key Highlights:

- Increased Limits: RBI raises UPI 123PAY per-transaction limit from Rs 5,000 to Rs 10,000.

- UPI Lite Wallet: Limit increased to Rs 5,000, with the per-transaction limit now set at Rs 1,000.

- Financial Inclusion: Changes aim to boost access to digital payments for feature phone users and those making small-value transactions.

- Economic Impact: Enhanced limits expected to ease banking system loads and drive further digital payment adoption.